Day 1: Pillars of Family Wealth & Business Succession Planning

Session 1: Family Wealth & Business Succession Planning

Session 2: Wealth Holding Structures

Session 3: Generational Wealth Strategies

Day 2: Dynamics of Family Wealth & Business Succession Planning

Session 4: Family Governance

Session 5: Why Family Conflicts Always Creep In

Session 6: Mitigating Asian Cultural Flaws

Day 3: Strategies for Family Wealth & Business Succession Planning

Session 7: Family Wealth is Best Managed by the Family

Session 8: When Unrelated Partners Share a Business

Session 9: Non-family Key Executives in Your Succession Plan

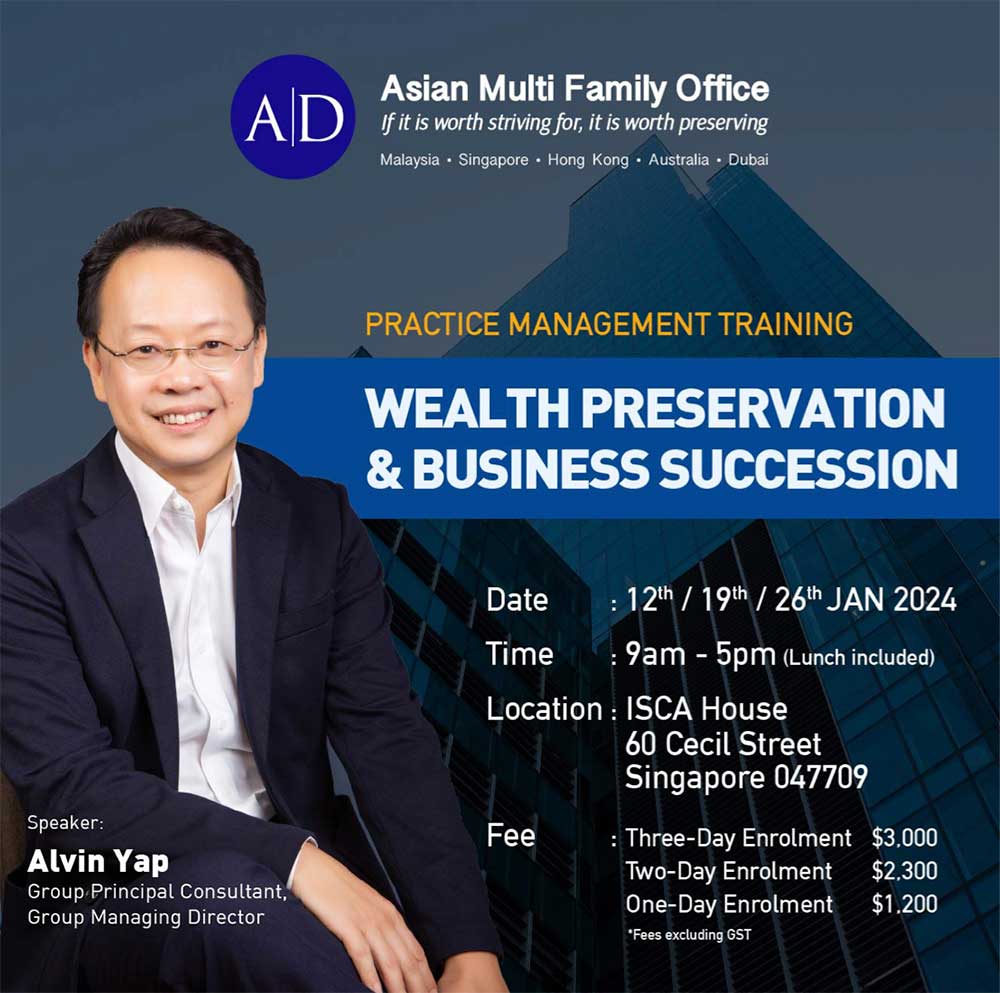

SPEAKER PROFILE:

Alvin Yap is the Principal Consultant and Group Managing Director of A.D. Financial Group. Under his leadership, the Group has expanded its footprint throughout the Asia-Pacific region, with offices from Malaysia to Singapore, Australia and Hong Kong. We also have corporate partnerships in Dubai.

He is highly sought-after as a speaker in international family wealth planning seminars. His expertise in business succession planning has led many business owners and founders of listed companies from Malaysia, Indonesia, Australia, Thailand, Vietnam, Singapore, and China to seek his advice on their complex business continuation and personal wealth matters.

A strong believer in Preservation First, Accumulation Second and Distribution Last, Alvin injects a fresh perspective on how a family's wealth legacy and Asian values can be preserved for many generations.

A.D. FAMILY OFFICE GROUP is an independent Asian Multi Family Office consulting firm founded in 2003 in Kuala Lumpur, Malaysia. Having advised Asian families on family relations and wealth preservation strategies, ADFG is currently providing Family Office management services exceeding US$10 billion in networth. The group has further expanded its footprint throughout Asia with established offices in Singapore, Hong Kong, Australia and Dubai.